The cryptocurrency (also known as crypto) is platform for digital payments that removes need to carry cash. It is only available as digital format, however, while most people utilize it for transactions online it is also possibility to make physical transactions. In contrast to traditional currency printed by government agencies, many businesses offer cryptocurrency.

They are fungible which means they have same value whether it is sold, bought or traded. term “cryptocurrency” is not synonymous with non fungible tokens (NFTs) with different value. As an example, dollar in crypto is always one dollar. value of an NFT dollar will depend on digital asset its tied to.

Even though government regulations dont exist on market for cryptocurrency however, these are tax deductible assets. tax obligation is to declare any loss or gain to IRS. Internal Revenue Service.

What is process of creating cryptocurrency?

Mining is term that’s used to define process that creates cryptocurrency. transactions in cryptocurrency must be authenticated through mining. Mining performs this confirmation and then creates new cryptocurrency. Mining makes use of specialized hardware as well as software to connect payments to blockchain.

Some cryptocurrency doesn’t come through mining. As an example, cryptocurrency cannot be used to purchase cant be extracted. Instead, developers build currency by using an infamous hard fork. process of forming hard fork makes an entirely new chain within blockchain. One fork takes latest path and another follows previous path. Bitcoin that you aren’t able to mine is usually used to fund investing rather than buying.

Currency that is digital is different from. traditional currencies

The central bank produces its conventional currency, which is in form of paper bills and coins that you can take with you on your travels or place into bank. currency can be used to make buying things and for other purchases which need cash. Traditional currency is supported by government but cryptocurrency is not subject to banks, government or financial institution control.

If you have option of holding traditional currencies in banks or financial institution, it is possible to keep cryptocurrencies safe in digital wallet. Banks protect money stored in bank accounts from loss however, crypto is not protected by any remedy in event in event of loss.

What are benefits of crypto?

In case of cryptocurrency market, it has advantages over traditional money. benefit that cryptocurrency has is its security. If you purchase through cryptocurrency, you dont require any information about yourself. This helps protect you from identity theft as well as other fraud acts. Whatever transpires with federal administration, your funds are safe.

A further benefit of cryptocurrency is fact that its worldwide and theres no requirement to calculate out or pay for fees for foreign exchange, though cryptocurrency isnt legally legal in many nations. Also, you dont have to fret about restrictions placed on your bank account for example, ATM limit on withdrawals.

The types of crypto

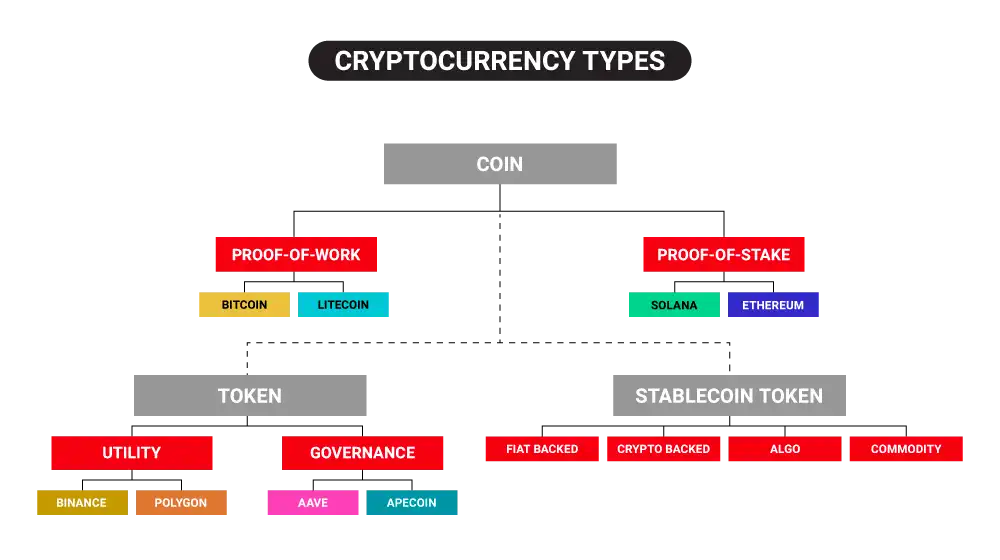

It is offered as tokens or coins. What differentiates them is fact that tokens can be found on blockchain unlike coins, which can be either tangible, digital or. Coins are more akin to conventional money, while they have their own blockchain. In contrast, token can be made on existing blockchain that can be utilized as currency or symbolize ownership of assets.

The first cryptocurrency that was introduced was Bitcoin which is most widely traded of all. Ethereum is second in popular cryptocurrency & is employed for more complex transactions. Others more commonly used cryptocurrencies that are referred to as altcoins are Cardano, Solana, Dogecoin as well as XRP.

Also read: Front end Development : Master Guide to Front-End Development 2024

How do I get started on cryptocurrency ?

In order to begin trading cryptocurrency first, select broker or crypto exchange. exchange is web based platform for trading crypto. Brokers make use of interfaces which interact with exchanges.

A cryptocurrency exchange lets you trade with no third party. If you choose to utilize an exchange service, youll need to locate people who will buy your crypto. Brokers can handle that for you. Below are steps needed for trading in cryptocurrencies.

1. Set up and then fund your account.

If youve chosen broker or exchange you want to use then next step is opening an account. It is important to have an identification document close by because some platforms will require that you present it. After you have verified authenticity of your account, youll be able to add funds to your account. Based on method you use to fund your account it may be necessary to wait for couple of days to see it deposited into your account in crypto.

2. Make purchase of cryptocurrency.

The first cryptocurrency purchase once your account is established and is verified. There are variety of options. It is possible to buy quantities as large or as youd want. Once you’ve decided on cryptocurrency youd like to begin with, select ticker symbol as well as quantity youd like to buy. most popular cryptocurrencies as well as their symbol include:

- Bitcoin (BTC)

- Ethereum (ETH)

- Dogecoin (DOGE)

- Tether (USDT)

- USD Coin (USDC)

- Uniswap (UNI)

3. Select storage technique

In most cases, youll save your cryptocurrency inside crypto wallet. If you buy from an exchange, you may not be able to choose way you keep your cryptocurrency. You can however choose between a cold or hot account when buying from an exchange.

Hot wallets

Hot wallets are cryptocurrency wallet which offers storage online that you are able to connect to from your computer mobile, tablet or phone. hot wallet poses potential for security issues due to fact that its hosted on internet & therefore more vulnerable to cyber attacks.

The cold wallet

The cold wallet isnt connected directly to web. It can be stored on an external device, for example, an USB device. Youll be provided with keycode that you can store in secure place. In event that you lose your code, you might be denied access to crypto wallet or cryptocurrency.

Are you ready to start your journey with cryptocurrency?

Cryptocurrency can be used to fund investments in trading, employment & investment. Prior to starting learning more about crypto related technology and way it operates through Coursera.

Bitcoin as well as Cryptocurrency Technologies, which is offered through Princeton University, is an online course which explains way Bitcoin operates and how it is different about it. This course will explain what factors into value and direction of crypto.

What is reason there are numerous varieties of crypto?

Important to note that Bitcoin differs from other cryptocurrency all over world. Although Bitcoin is most popular and most valued cryptocurrency, its huge market.

More than 2 million different cryptocurrency types that exist, as per CoinMarketCap.com, market research site. While some cryptocurrency offer market value totals of billions of dollars, many arent well known and have no value at all.

If youre considering entering cryptocurrency market is good idea to begin with coin that is traded frequently and is relatively established in marketplace. coins usually have highest value in terms of market capitalisation.

A careful selection of your crypto However, there isnt promise of success in highly volatile market. There are times when problem that is part of intricately interconnected crypto sector can spread and impact entire value of assets.

As an example, in month of November 2022, market suffered significant blow because exchange for cryptocurrency FTX was unable to resolve problems with liquidity, accompanied by surge in withdrawals. fallout grew across cryptocurrency market, both big as well as small witnessed their value plunge.

Are cryptocurrencies financial securities, like stocks?

If cryptocurrency is something that is considered security remains bit of grey area moment. For bit of background typically it is “security” in finance is any thing that has value and is able to be traded. Securities are considered securities since they signify ownership of an organization that is publicly traded. Securities are bonds because they are form of debt to bond holder. They also can be traded on publicly traded market.

Regulators are now beginning to suggest that cryptocurrencies must be similarly regulated as other kinds of securities, like bonds and stocks. However, this approach is getting opposition from scholars, lawyers companies as well as some of largest companies in cryptocurrency industry have opposed this idea by arguing that regulations applicable to bonds and stocks, as an example, arent applicable equally to cryptos. The Securities and Exchange Commission has focused its attention on entire crypto industry. commission has expressed questions about certain