Sources of Personal Finance

Hook: Did you know 64% of Americans live paycheck to paycheck, yet there are more funding sources available today than at any point in human history? The problem isn’t scarcity—it’s awareness.

Your relationship with money transforms when you realize sources of personal finance aren’t just banks and paychecks. They’re the invisible oxygen fueling your dreams, businesses, and security nets. Let’s reframe how you see financial resources forever.

Understanding diverse sources of personal finance empowers individuals to build financial resilience.

Your primary job remains the most foundational of all sources of personal finance for monthly budgeting.

Side hustles and freelance work have emerged as vital modern sources of personal finance.

Part 1: The Traditional Ecosystem – More Than You Realize

1.1 Institutional Lending: Banks, Credit Unions & Beyond

While most think “loan = bank,” the nuances matter:

- Credit Unions: Member-owned cooperatives like Navy Federal offer rates 1-2% below traditional banks. Their “relationship pricing” rewards loyalty .

- Community Development Financial Institutions (CDFIs): For underserved communities, these provide microloans with counseling. Organizations like Opportunity Fund report 79% survival rates for businesses they fund .

- Credit-Builder Loans: Tools like Self Lender don’t lend based on credit—they build it by holding funds in a secured account while reporting payments .

Pro Tip: Use Bankrate or NerdWallet to compare rates across 100+ lenders instantly—saving thousands on interest .

1.2 Government as Your Silent Partner

Beyond student loans, tap into:

- FHA 203(k) Loans: Finance home purchases plus renovations in one mortgage (perfect for house hackers) .

- SBA Microloans: Up to $50k for businesses with no collateral—often paired with free training .

- Utility Assistance Programs: The Low-Income Home Energy Assistance Program (LIHEAP) covers heating/cooling costs for eligible households .

Investment dividends can evolve into powerful passive sources of personal finance over time.

Family gifts or inheritances occasionally supplement traditional sources of personal finance during major life events.

Government assistance programs serve as critical sources of personal finance during economic hardship.

1.3 Employer-Sponsored Goldmines

Maximize hidden workplace benefits:

- ESPPs: Employee stock purchase plans often offer 15% discounts on company stock.

- HSA/FSA Accounts: Triple tax advantages for medical expenses—invest unused HSA funds like a retirement account.

- Tuition Reimbursement: Companies like Starbucks cover 100% of online degrees for employees working 20+ hrs/week.

Part 2: The Modern Disruptors – Finance in Your Pocket

2.1 Peer-to-Peer (P2P) & Crowdfunding

- LendingClub: Investors fund your loan at rates beating banks (avg 10.68% vs 12.1% for credit cards) .

- Kickstarter vs Indiegogo: $6.5B+ raised since 2009. Hardware projects thrive on Kickstarter; creative causes on GoFundMe.

- Real Estate Crowdfunding: Fundrise lets you co-own apartment buildings with $10—earning passive rental income .

2.2 Fintech’s Algorithmic Revolution

- Robo-Advisors: Betterment charges 0.25% to auto-rebalance portfolios—outperforming 80% of humans over 10 years .

- “Buy Now, Pay Later” (BNPL): Affirm and Klarna split payments at 0% interest if repaid on time—used by 44% of Gen Z .

- Neobanks: Chime spots paychecks up to 2 days early—a lifeline for cash-strapped gig workers .

Table: Traditional vs Modern Funding Sources

| Source | Best For | Speed | Risk Profile |

|---|---|---|---|

| Traditional Bank Loan | Large purchases (homes) | 30-60 days | Low (fixed rates) |

| P2P Lending | Debt consolidation | 5-7 days | Medium |

| Crowdfunding | Creative projects | 30-90 days | High (all-or-nothing) |

| BNPL Apps | Small immediate needs | Instant | Medium (late fees) |

Part 3: Self-Employed & Side Hustle Finance – Your Business as an ATM

Entrepreneurs have unique options per the DPSEP framework :

3.1 Separating Personal and Business Oxygen

- Business Credit Cards: Build a company credit file using EIN vs SSN (e.g., Brex Card).

- Revenue-Based Financing: Companies like Pipe offer cash advances against future SaaS revenue—no personal guarantees.

- Equipment Financing: Collateralize the printer/factory machine itself for lower rates.

Retirement accounts like 401(k)s transform long-term savings into future sources of personal finance.

Real estate rentals offer tangible sources of personal finance through consistent tenant payments.

Peer-to-peer lending platforms now enable innovative sources of personal finance beyond banks.

3.2 Gig Economy Fuel Stations

- Upwork’s Instant Pay: Freelancers cash out earnings same-day for 1% fee.

- Uber’s Instant Pay: Drivers access fares immediately post-ride—crucial for covering gas or repairs.

- Etsy’s “Capital” Program: Sellers get loans based on sales history—deposited in 48hrs .

Case Study: Sarah, a baker, used Kiva’s 0% interest loan to buy a commercial oven. Paid back via 200 cake sales—now netting $8k/month .

Part 4: Community & Relationship Capital – The Invisible Bank

4.1 Rotating Savings and Credit Associations (ROSCAs)

Known as “tandas” in Mexico or “susus” in Ghana, these informal pools collect $50-$500/month from members, rotating the lump sum. Over 3 billion adults use them globally .

4.2 Family Financing Structures

- Intra-Family Loans: Draft formal agreements at IRS-approved rates (July 2025: 4.12% for 3+ year loans).

- Advance Inheritance: Access estate funds early for medical crises via companies like Inheritance Advanced.

4.3 Barter Economies

Trade skills tax-free under $600/year:

- “I’ll build your website if you fix my car.”

- Platforms like Simbi automate swaps—1.2 million users traded in 2024 .

elling unused items online unlocks unexpected sources of personal finance from clutter.

Royalties from creative work provide niche sources of personal finance for artists and inventors.

Part-time gigs in the gig economy diversify sources of personal finance for flexibility seekers

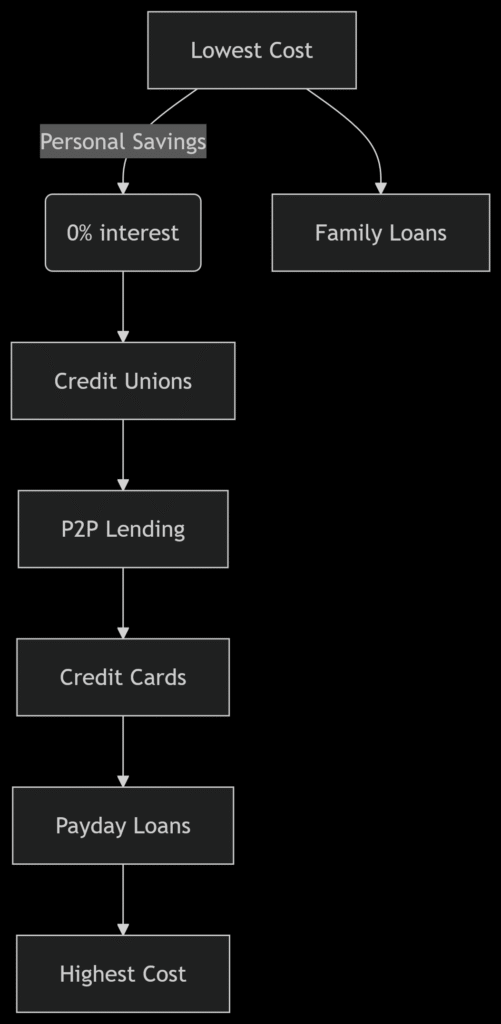

Part 5: Hierarchy of Financial Oxygen – What to Breathe First

Prioritize sources by cost and risk:mermaid graph TD A[Lowest Cost] -->|Personal Savings| B(0% interest) A --> C[Family Loans] B --> D[Credit Unions] D --> E[P2P Lending] E --> F[Credit Cards] F --> G[Payday Loans] G --> H[Highest Cost]

Rules of Thumb:

- Never use high-interest debt for depreciating assets (e.g., vacations on credit cards).

- Match loan duration to asset lifespan: 30-year mortgages ✅, 5-year loans for phones ❌.

Also read: Personal Finance in School: The Revolution Transforming Teen Financial Futures 2025

Conclusion: Your Financial Ecosystem Awaits

Sources of personal finance are now democratized—from algorithms in Silicon Valley to village savings circles. Yet 57% of Americans don’t compare funding options before borrowing . That ends today.

“Most people don’t plan to fail—they fail to plan.” – John L. Beckley

Educational scholarships and grants represent non-repayable sources of personal finance for students.

Interest from high-yield savings accounts strengthens low-risk sources of personal finance.

Business profits directly fuel entrepreneurial sources of personal finance for self-employed individuals.

Your Action Plan:

- Audit Your Oxygen Mix: List all current funding sources—are they optimal?

- Test 1 New Source This Month: Try CashCourse for education or PowerPay for debt strategies .

- Build a “Finance Ladder”: Start with low-cost sources (savings/family), climb to higher tiers only when essential.

Over to You: What’s the most unconventional funding source you’ve used? Share your story below—let’s redefine “where money comes from” together.